Athletics facilities improvements tip off this fall with renovations for both Catamount basketball teams.

Women's golf wins four titles, earns trip to the postseason in 2022-23.

Forty years ago, the Catamounts made a miraculous run to the national championship game.

WCU is helping improve children’s reading and writing skills through new professorship

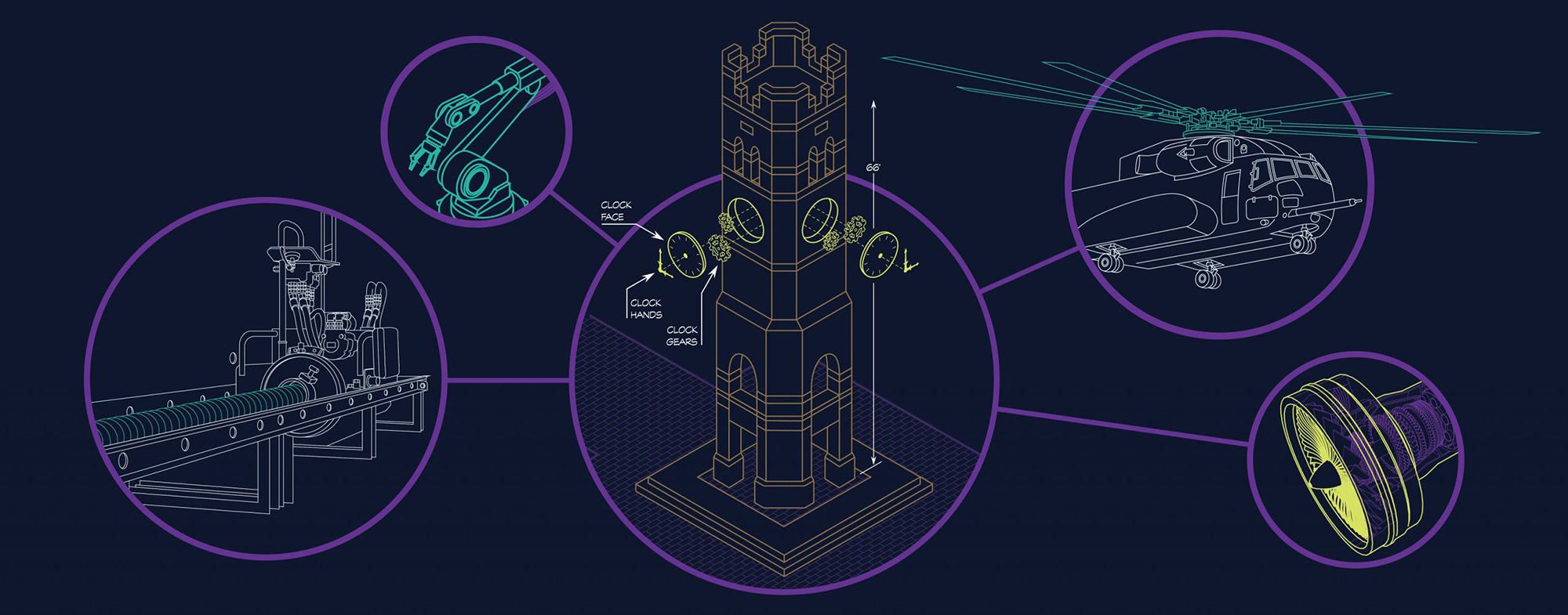

Expansion of WCU’s engineering programs receives support from the General Assembly and industry partners

One Day for Western, GivingTuesday provide opportunities for philanthropic support

Walking into the first day of their introductory English class in the spring of 1994 taught by the late Nell Holtzclaw, Ilona and Andrew Gordon ’04 had no idea this freshman course at Western Carolina University would be the start of their life as husband-and-wife bestselling authors.

In the middle of bustling Washington and just a few hundred feet to the right of the Capitol Building, is the office of the chief diversity and equity officer for the U.S. Department of Labor and Western Carolina University alumna, Alaysia Black Hackett ’01, MPA ’02.

“Outer Banks” was released on Netflix in early 2020, in the peak of the COVID-19 pandemic. The show follows a group of teenagers in the Outer Banks — an island of haves, have-nots and clique-based rivalry and romance — as they hunt for a legendary treasure linked to a father’s mysterious disappearance.

After pausing for two years of “stoppage time” during the height of the global COVID-19 pandemic in 2020 and 2021, it’s been “play on” for participants in Western Carolina University’s “Old-Timers Soccer Reunion.”

In the heart of downtown Cherokee is a culturally-based coffee shop called Qualla Java. Qualla Java is named after the Qualla Boundary, the land trust of the Eastern Band of Cherokee Indians.

This fall I celebrate my third anniversary at WCU and I’m looking forward to the first normal campus year in Cullowhee since 2019.

Higher education plays a starring role in Mario Van Peebles melting pot western ‘Outlaws Posse’

The WCU Board of Trustees appointed Jeff Lawson as dean of the Graduate School and Research as part of its regular meeting June 9. Lawson will start in his new position July 1.

Yue Hillon, professor of management in the College of Business, has been appointed to the university’s position of Wesley R. Elingburg Distinguished Professor of Business Innovation, effective July 1.

Freshman Avery Pittman wowed judges with an idea for 3D virtual dorm room tours for incoming freshmen.

Yanjun Yan, associate professor the College of Engineering and Technology, has been named the recipient of the 2023 University of North Carolina Board of Governors Award for Excellence in Teaching.

Evelyn Rucker has been named the new Intercultural Affairs director at WCU.

On March 1, WCU named Amber Clawson Albert as the director of the Mountain Heritage Center following the retirement of Pam Meister in December 2022.

Stacey R. Miller, former associate athletics director for student success, has been named the university’s next director of alumni engagement.

Robert Walker has been named the associate vice chancellor for auxiliary enterprises, replacing Keith Corzine who retired Jan. 1 after more than 34 years at the university.